Introduction

Cyberattacks are like the modern-day boogeyman for small and medium businesses (SMBs). The threats lurk in every email link, unsecured device, or poorly configured firewall. Unlike the boogeyman, though, these attacks can do serious harm — stealing data, crippling operations, and draining finances. For many SMBs, cyber insurance is the knight in shining armor. But is it worth the investment? Let’s break it down.

What Is Cyber Insurance?

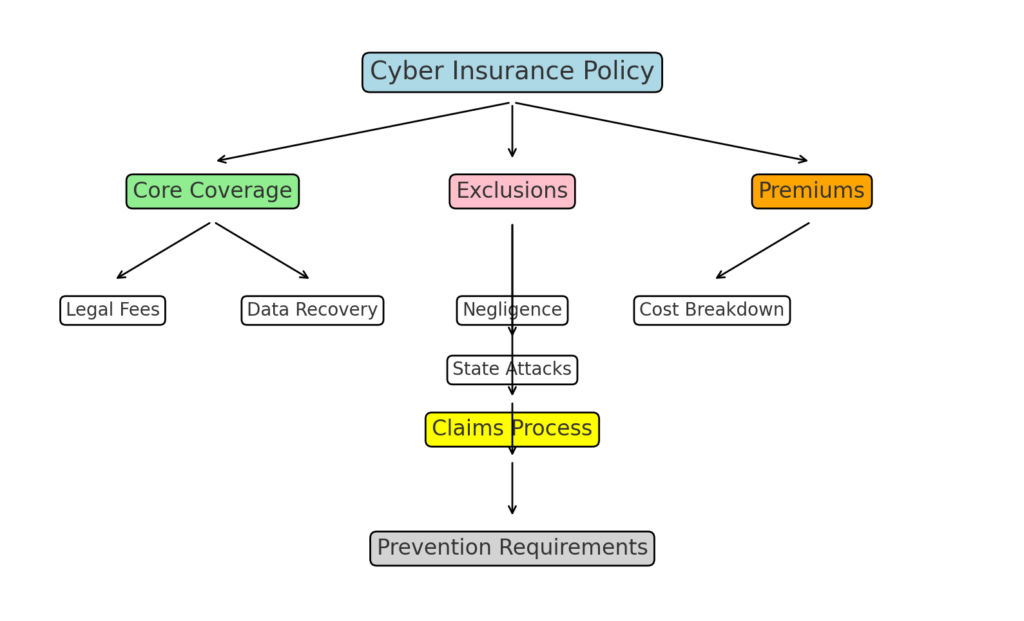

Cyber insurance, also known as cyber liability insurance, is designed to protect businesses from the financial fallout of cyberattacks and data breaches. Policies typically cover costs like:

- Legal fees: For lawsuits stemming from data breaches.

- Notification costs: Informing affected customers.

- Ransomware payments: If hackers hold your data hostage.

- Business interruption: Loss of income during downtime.

While it sounds like a safety net every SMB should have, the devil is in the details.

The Case For Cyber Insurance

1. Rising Threat Landscape

Cyberattacks are becoming more frequent and sophisticated. Phishing, ransomware, and denial-of-service attacks target SMBs because they often lack robust defenses. Cyber insurance provides financial relief when these attacks occur.

2. Regulatory Compliance

Depending on your industry, laws like GDPR or CCPA might require specific measures after a breach. Cyber insurance ensures you can afford to meet these obligations.

3. Peace of Mind

Running a business is stressful enough without worrying about whether you’ll survive a major cyber event. Insurance provides a cushion for worst-case scenarios.

The Case Against Cyber Insurance

1. Cost

Policies aren’t cheap. Premiums range from $500 to $5,000 annually, depending on the size of your business and the level of coverage. For some SMBs, this is a stretch.

2. Coverage Limitations

Insurance doesn’t cover everything. Most policies exclude:

- Attacks from state-sponsored hackers.

- Pre-existing vulnerabilities.

- Losses from poor employee practices, like sharing passwords.

3. False Security

Relying on insurance might make SMBs less likely to invest in preventative measures like firewalls, backups, or employee training. It’s a classic case of treating the symptom, not the disease.

Factors to Consider When Choosing a Policy

1. Understand Your Risks

Evaluate your specific vulnerabilities. Are you storing sensitive customer data? Do employees work remotely? Identifying these risks will help you choose the right coverage.

2. Assess Coverage Options

Not all policies are created equal. Look for coverage that includes:

- Ransomware attacks

- Data restoration

- Third-party lawsuits

3. Read the Fine Print

Exclusions and conditions can make or break the value of your policy. For example, some insurers require proof of regular security audits.

4. Compare Costs

Shop around and get quotes from multiple insurers. Consider bundling cyber insurance with other business policies for discounts.

Anatomy of a Cyber Insurance Policy

Final Verdict

Cyber insurance can be a lifesaver for SMBs, but it’s not a silver bullet. Think of it as one tool in a broader cybersecurity strategy. Combine insurance with strong defenses like:

- Employee training.

- Regular backups.

- Multi-factor authentication.

Investing in these basics might even reduce your premiums. In the end, whether cyber insurance is worth it depends on your risk tolerance, budget, and industry requirements.

For some SMBs, skipping insurance is like playing poker with your data. For others, it might feel like buying a lottery ticket you’ll never cash in. Either way, it’s a decision that deserves careful thought.

Call to Action

If you’re unsure where to start, consult a cybersecurity expert to assess your risks and explore whether cyber insurance fits your business needs. Remember: prevention is cheaper than cleanup!

Justyna Flisk

Justyna Flisk, Senior Editor at Decoded.cc, combines her expertise as a Senior Software Engineer and AI R&D Manager to deliver sharp, forward-thinking content on technology and artificial intelligence. With a passion for innovation, Justyna bridges the gap between technical depth and clear storytelling, ensuring readers stay ahead in the fast-evolving AI landscape.

Leave a Reply